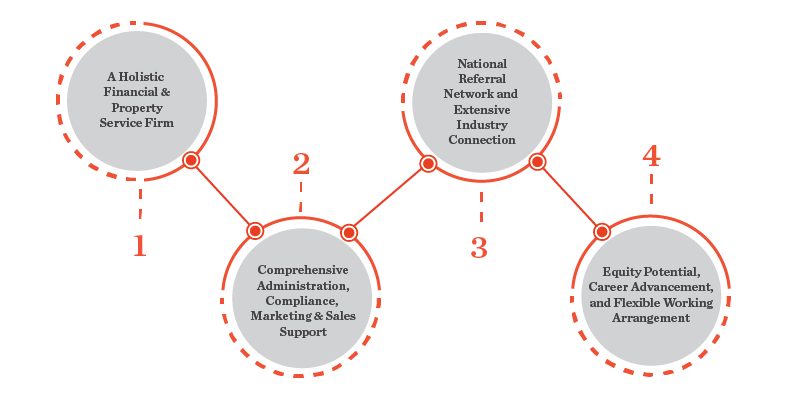

A Holistic, Financial Advisory-Led Wealth-Building Solution

The Hopkins Group is an award-winning holistic wealth-building firm with over 32 wealth-building services and products available, covering the entirety of your wealth-building journey, including:

We pride ourselves on our ability to provide integrated, holistic service offerings to you under one single roof, no matter where you are in your wealth-building journey:

As a testament to our deep capability in offering holistic financial & property advisory, we were named by the Independent Financial Association (IFA) ‘Holistic Advice Firm of the Year’ in 2022 and 2023, as well as ‘IFA Excellence Award – Company’ in 2023.

Please download our capability statement here for more information on our holistic service offering and capability.

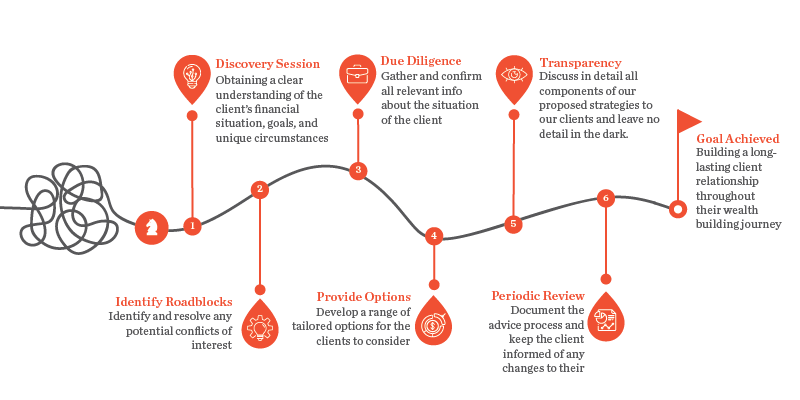

Our Client-First Wealth-Building Strategy

We understand that the best strategy starts with our clients. We do so by implementing a client-first wealth-building strategy for every one of our financial planning clients:

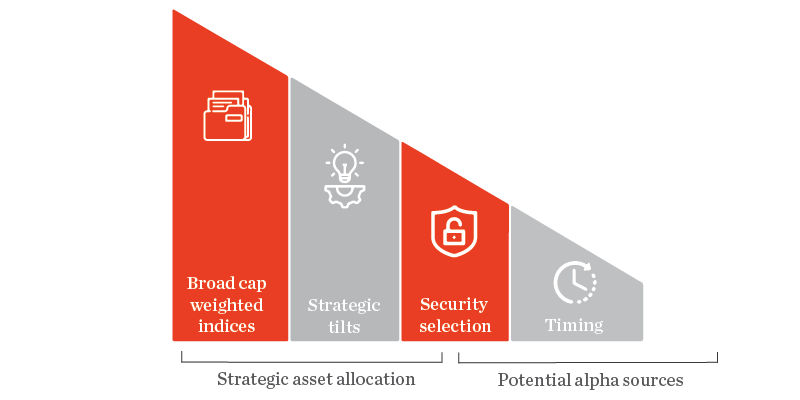

THG Investment Philosophy

Successful investing goes beyond individual stock selection. At THG, asset allocation is the cornerstone of a strong portfolio. This refers to the strategic mix of different asset classes (e.g., stocks, bonds, cash) within your portfolio, and it's the primary driver of your returns.

Furthermore, THG adopts a conservative approach in wealth-building and wealth management, with a tiered approach in our investment process to ensure we protect, preserve and grow your wealth sustainably without exposing your assets to excess risk:

Why Do You Need Financial Planning?

Financial Advisory & Coaching

Financial advisory services go beyond simple investment management, and it is a complex endeavour, requiring ongoing analysis, strategy development, and implementation.

Learn more

Financial advisors understand the complexities of navigating the financial landscape. Market fluctuations, tax regulations, and evolving economic conditions can significantly impact your financial well-being. By engaging with a financial advisor, we will be able create a wealth-building plan that is tailored to your specific circumstances and risk tolerance by:

1. Conduct a comprehensive financial needs analysis, assessing your current financial situation and future aspirations.

2. Develop a customised investment strategy aligned with your risk tolerance and long-term goals.

3. Recommend suitable investment products to diversify your portfolio and optimise returns.

4. Continuously monitor your portfolio performance, adjusting as necessary to adapt to market changes and your evolving needs.

5. Provide ongoing communication and clear explanations, ensuring you understand the rationale behind financial decisions.

SMSF & Superannuation Advice

A SMSF & Superannuation is a specialised type of superannuation fund where you, as the trustee, have complete control over the investment decisions. This offers greater flexibility than traditional retail or industry super funds, allowing you to invest in a broader range of assets and potentially optimise your long-term returns. However, managing an SMSF & Superannuation is a complex undertaking. It requires a deep understanding of superannuation regulations, investment strategy, and ongoing administrative tasks like tax reporting and compliance. This can be time-consuming and overwhelming for busy individuals.

Learn more

Our experienced financial advisors can simplify the process and help you navigate the complexities of an SMSF & Superannuation. We offer comprehensive guidance on:

- Establishment: We assist with setting up your SMSF & Superannuation and ensure it complies with all ATO regulations. Investment

- Strategy: We tailor an investment plan based on your risk tolerance, retirement goals, and - investment preferences.

- Ongoing Administration: We handle the day-to-day tasks such as tax lodgements, annual returns, and record-keeping.

- Compliance & Regulations: We ensure your SMSF & Superannuation adheres to all relevant legislative requirements.

By partnering with us, you can leverage the benefits of an SMSF & Superannuation while minimising the administrative burden. This allows you to focus on what matters most – achieving your financial goals and enjoying a secure retirement.

Estate & Succession Planning

Estate and succession planning involve creating a comprehensive strategy to distribute your assets after your passing. This includes essential documents like wills, trusts, and powers of attorney, which dictate how your beneficiaries will receive your inheritance.

Learn more

Managing this process yourself can be challenging. Navigating complex legal and tax regulations can be time-consuming and lead to unintended consequences. Additionally, life circumstances can change, requiring constant adjustments to your plans to ensure they remain aligned with your wishes. Our experienced financial advisors can streamline this process by:

1. Understanding your goals: We work closely with you to understand your family dynamics, financial objectives, and how you envision your legacy.

2. Inventorying your assets: We'll identify all your assets, including property, investments, and personal belongings.

3. Developing a customised plan: We'll create a tailored plan that minimises taxes, protects your assets, and ensures a smooth transfer of wealth to your beneficiaries.

4. Regular review and updates: We'll continuously monitor your estate & succession plan and recommend adjustments as your circumstances or legal frameworks evolve.

Retirement planning goes beyond simply accumulating savings. It involves a comprehensive strategy that addresses income needs, tax implications, healthcare considerations, and your desired lifestyle in retirement. This can be overwhelming, especially when navigating complex financial products, investment decisions, and potential changes to government benefits.

Learn more

Managing on your own retirement planning requires extensive research, understanding tax regulations, and continuously monitoring your portfolio against market fluctuations. This can be stressful and time-consuming, especially as you approach retirement when your focus may naturally shift towards enjoying this next chapter.

How our financial advisors can help: Our experienced advisors work closely with you to understand your retirement goals, risk tolerance, and income expectations. They can:

1. Develop a personalised retirement plan: Tailored to your specific circumstances, this plan considers your assets, liabilities, and desired retirement age.

2. Optimise your investment portfolio: Ensure your investments are aligned with your risk tolerance and generate the income needed throughout retirement.

3. Navigate tax implications: Develop tax-efficient strategies to minimise your tax burden during retirement.

4. Develop a comprehensive estate plan: Secure your legacy by ensuring your assets are distributed according to your wishes.

5. Succession planning for businesses: Guide business owners through the process of transferring ownership or leadership roles to ensure a smooth transition.

Trust Establishment & Management

Protecting your legacy and ensuring your assets are distributed as you intend requires careful planning. Trusts are legal structures that allow you to transfer ownership of assets (such as property, investments, or cash) to a trustee, who then manages them for the benefit of beneficiaries that you can nominate.

Learn more

Establishing and managing a trust can be a complex process. There are various types of trusts with different legal regulations and tax implications. Understanding these complexities and ensuring the trust is set up correctly is crucial for its effectiveness. Attempting to do this yourself can lead to costly mistakes, potential legal challenges, and unintended consequences for your beneficiaries. Our experienced financial advisors can guide you through the entire process. We will help you:

- Choose the right type of trust to meet your specific needs and goals.

- Draft the trust deed, ensuring it accurately reflects your wishes and complies with legal requirements.

- Identify and appoint a suitable trustee, ensuring responsible management of the trust assets.

- Navigate ongoing trust administration, including investment management, tax reporting, and distribution of benefits to beneficiaries.

Managing a significant pool of assets and navigating complex financial decisions can be overwhelming. Our Family Office service offers a personalised solution, integrating financial planning, investment management, and strategic guidance for a cohesive approach to your long-term wealth goals.

Learn more

Family Office services are designed to cater to the specific needs of high-net-worth individuals and families, as managing these elements independently requires significant time, expertise, and ongoing research.

Our team of experienced financial advisors acts as a trusted partner, providing comprehensive oversight and guidance across your entire financial picture. We work closely with you to understand your unique goals and risk tolerance, crafting a personalised strategy that encompasses wealth preservation, growth, and intergenerational wealth transfer. This may involve investment management, tax planning, philanthropic strategies, and ensuring your legacy aligns with your wishes.

By leveraging our expertise, you can gain peace of mind, knowing your wealth is managed with a long-term perspective. We free you to focus on your priorities while ensuring your financial future remains secure.

Insurance Review & Planning

Understanding and managing your insurance portfolio can be complex. Multiple policies with varying coverage types, changing life circumstances, and evolving risk profiles can make it difficult to ensure you have the right protection in place. Our insurance review and planning service provides a clear and comprehensive approach to safeguarding your financial future.

Learn more

During an insurance review, our experienced advisors will:

- Analyse your existing insurance policies: We'll assess your life, health, disability, and property insurance coverage to understand your current level of protection.

- Identify coverage gaps: We'll evaluate your current and future needs, considering factors like family situation, income, and assets, to identify any gaps in your coverage.

- Develop a personalised insurance plan: Based on your risk tolerance and financial goals, we'll recommend -suitable insurance products to bridge those gaps and optimise your overall coverage.

This personalised approach offers several key benefits:

- Reduced risk of financial hardship: Ensuring adequate insurance coverage protects you and your loved ones from unexpected financial burdens in the event of illness, disability, or property damage.

- Improved peace of mind: Knowing you have the right insurance safeguards in place allows you to focus on achieving your financial goals with confidence.

- Cost-efficiency: We can help you identify and eliminate unnecessary duplication in your insurance coverage, potentially saving you money on premiums.

Intergenerational Wealth Transfer

Intergenerational wealth transfer involves planning the distribution of your assets to your beneficiaries after your passing. While this may seem straightforward, it can become intricate due to factors like tax implications, family dynamics, and asset types.

Learn more

Managing this process yourself can be challenging. Understanding complex tax laws, navigating potential family disputes, and ensuring your wishes are clearly documented require significant time and expertise. Additionally, DIY wealth transfer can lead to unintended consequences, potentially jeopardising the financial security of your loved ones. Our experienced financial advisors can guide you through every step of the intergenerational wealth transfer process. We'll work with you to:

- Develop a comprehensive plan: We assess your assets, liabilities, and family situation to create a customised plan that reflects your goals and minimises tax burdens for your beneficiaries.

- Optimise asset allocation: We ensure your assets are distributed strategically to maximise their value for future generations.

- Estate planning strategies: We develop strategies like wills, trusts, and beneficiary designations to clearly outline your wishes and minimise legal complexities.

- Tax-efficient solutions: We explore legal and investment options to maximise the value of your legacy and minimise tax implications for your beneficiaries.

Invesment Management & Asset Protection

Building wealth takes time and dedication. However, unforeseen circumstances and market volatility can threaten your financial security. Investment management and asset protection aim to mitigate these risks while ensuring your assets grow over time.

Learn more

Managing this on your own can be complex. You'd need to stay updated on market trends, understand complex investment strategies, and constantly assess your risk tolerance. This requires significant time, expertise, and a strong emotional detachment to avoid impulsive decisions. Our experienced financial advisors can simplify this process by working closely with you to understand your financial goals, risk tolerance, and time horizon. We then develop a personalised strategy that prioritises the safety of your principal investment while aiming for steady, sustainable growth. This includes:

- Risk Assessment: We analyse your current portfolio and risk tolerance to identify potential vulnerabilities.

- Diversification Strategies: We create a diversified portfolio that minimises exposure to any single asset class or market fluctuation.

- Investment Selection: We select low-risk, high-quality investments aligned with your goals and risk tolerance.

- Ongoing Monitoring & Adjustments: We continuously monitor your portfolio, making adjustments as necessary to maintain stability and optimise performance.

Investing for long-term wealth creation can be a complex endeavor. Market research, asset allocation, and ongoing portfolio adjustments require significant time, expertise, and emotional discipline. A Managed Account offers a solution by placing your investment decisions in the hands of a trusted financial advisor.

Learn more

Here's what an MDA entails:

- Delegation of Authority: You grant your advisor the discretion to buy and sell investments within your pre-defined investment strategy.

- Active Management: Your advisor continuously monitors market conditions, adjusts your portfolio as needed, and rebalances to maintain your risk tolerance.

- Reduced Complexity: MDAs eliminate the burden of daily market analysis and investment selection, freeing you to focus on your core business or professional pursuits.

Benefits of Utilising an MDA with Our Financial Advisors:

- Expert Guidance: Our advisors leverage their extensive experience and market knowledge to make informed investment decisions aligned with your goals.

- Discipline and Emotionless Investing: Our advisors remove emotional bias from the investment process, ensuring objective decision-making based on your long-term plan.

- Time Efficiency: MDAs free up your valuable time, allowing you to focus on other priorities while your investments are actively managed.

- Transparency and Regular Communication: We maintain clear communication, providing regular reports on your portfolio performance and investment activity.

Expat Financial Advice

Managing your finances becomes even more intricate when you live overseas. With over 15 years of experience in Expat financial advice, THG has established strong relationships and partnerships with various international tax advisors and specialists and a deep understanding of the UK and the US’s unique landscape and requirements, such as the National Insurance Scheme Payment/ 401k.

Learn more

Our experienced expat financial advisors can simplify the process of navigating complex tax implications, currency fluctuations, and international investment opportunities.

By working closely with you to understand your unique circumstances, financial goals, risk tolerance, and tax residency, we design and deliver a personalised that can help you:

- Understand Tax Implications: We analyse tax laws in your home country and your new residence to minimise potential tax burdens.

- Develop Currency Management Strategies: We create a plan to mitigate the impact of currency fluctuations on your assets and income.

- Invest in Global Markets: We explore suitable investment opportunities across different markets, considering your risk tolerance and long-term goals.

- Plan for Retirement: We ensure your retirement savings strategy remains on track despite being abroad.

Tax Strategy & Optimisation

Australian tax regulations can be complex, especially for those with significant assets or income. Our tax optimisation strategies help you navigate the system legally and efficiently, minimising your tax obligation and maximising your after-tax wealth

Learn more

Our experienced tax specialists collaborate with your financial advisor to ensure a cohesive strategy that considers both your financial goals and tax implications. Here's how we can help:

- Identify Deductions & Offsets: We meticulously analyse your financial situation to uncover all applicable tax deductions and offsets you may be missing.

- Optimise Investment Strategies: We explore tax-efficient investment options that align with your risk tolerance and long-term goals.

- Superannuation & Retirement Planning: We ensure your superannuation contributions are optimised for tax benefits and your retirement strategy remains tax-effective.

- Compliance & Reporting: We ensure your tax filings are accurate and compliant, minimising the risk of penalties and audits.

Aged Care Specialist

Planning for aged care can be a complex and emotionally charged process. Understanding the financial implications, navigating government regulations, and optimising your assets for potential care needs require specialised knowledge.

Learn more

Our Aged Care Specialist advisors offer comprehensive guidance to ensure your financial security throughout your retirement. They possess in-depth knowledge of aged care funding options, government benefits, and asset protection strategies.

- Understand Aged Care Costs: We clarify the different types of aged care facilities and their associated costs.

- Maximise Government Benefits: We explore opportunities to utilise government subsidies and concessions to minimise your financial burden.

- Optimise Asset Protection Strategies: We develop a plan to safeguard your assets while ensuring eligibility for aged care funding.

- Develop a Sustainable Funding Plan: We create a personalised strategy considering your income, savings, and expected future expenses.

Lending Strategies & Debt Management

Debt can be a powerful tool for building wealth, but Navigating the complexities of loans, interest rates, and repayment structures can be challenging. Furthermore, DIY debt management might lead to missed opportunities for lower rates, inefficient allocation of funds towards high-interest debts, and difficulty reaching long-term financial goals.

Learn more

Our lending strategies and debt management service help you leverage debt strategically while ensuring financial stability. Led by our experienced financial advisors and supported by our team of in-house accountants, we can help you:

- Assess Your Debt Landscape: We analyse your current debts, including interest rates, repayment terms, and balances.

- Develop a Personalised Repayment Plan: We create a strategic plan to effectively prioritise and pay off high-interest debts.

- Explore Refinancing Options: We identify opportunities to secure lower interest rates on existing loans, saving you money in the long run.

- Integrate Debt with Investment Strategies: We help you leverage debt strategically to invest in assets with the potential for higher returns, accelerating wealth creation.

- Build Towards a Debt-Free Future: Our advisors help you achieve your financial goals, including debt-free ownership of your home or investment properties.