BLOG

25/10/2023

Superannuation has undoubtedly been an area that many Australian’s either don’t fully understand or outright ignore. This lack of interest and or awareness has led many individuals to receive suboptimal outcomes with their retirement savings.

Compulsory superannuation was first introduced in 1992 in a bid to ensure that the aging population of Australia was going to be able to support themselves in retirement without the need to rely on Social Security.

The government at the time implemented a carrot and stick policy in order to convince Australian’s to save for their own retirement.

The stick: Whilst the amounts have changed over the years currently 10% of your salary must be paid to your nominated fund. In the event you don’t nominate a fund your employer will nominate one for you. So statistically for every fortnight you work one day is spent working for your retirement savings.

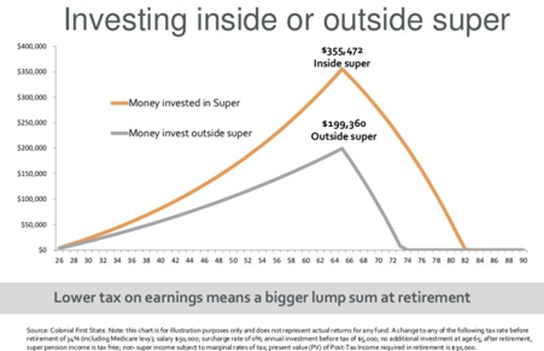

The Carrot: In order to encourage people to save for their own retirement superannuation has a concessional tax rate. Currently the tax rates are 15% for those in an accumulation fund and 0% for those in a pension fund. The outcome of this is if a 26-year-old earning $50,000 per annum invested $5,000 per annum inside superannuation versus invested $5,000 in their own name. After 40 years the value of the investment inside would be $355,472 inside superannuation and $199,360; i.e. you end up with 78% more funds just due to the favorable tax structure. The benefit of this increases further with higher income earners. See figure 1.

Figure 1.

In summary, for the average Australian worker once a fortnight they are working for their retirement fund. It pays to take some time to work out where these funds go and where they are invested. If savings are for the purpose of funding retirement superannuation should be at the top of your considerations due to the favorable tax structure.

Following mandatory superannuation in Australia the superannuation industry has become a $3.3 trillion dollar industry (Association of Superannuation Funds Australia, 2021). There are many products out there to choose from, and just like any other product, some are better than others.

The two key factors that will contribute to an individual’s ability to grow their superannuation balance over time: Fees & charges and the correct asset allocation mix.

Fees:

Each superannuation fund charges a mix of flat member fees, tiered administration fees and investment management costs. There can also be other costs imbedded into your investment management fees such as transactional costs, property costs, borrowing costs and performance fees. These can be difficult to find and may require a thorough read of your relevant product disclosure statement.

However, just like adding an extra 0.5% to your investment returns will compound over time and produce a greater balance, so will reducing the amount of fees charged to your account.

Asset allocation mix:

The correct asset allocation mix is the most important determinant of your investment returns. The mix of growth and defensive assets that the funds are invested in is therefore incredibly important to maximising the superannuation balance at retirement.

There is strong link between portfolio asset allocation and investment timeframes. A longer time period allows for a full market cycle to ride out any volatility, and experience the investment returns of a full cycle whereas a shorter investment timeframe can result in volatility forcing an investor to exit their position in a down market.

The important thing about superannuation savings is that they cannot be accessed until you reach preservation age and retire or reach age 65. This means that for most Australians (under age 55) their investment timeframe is over 10 years which allows time for a full market cycle.

Alternatively, older Australians may find that as they approach retirement their investment window is getting shorter. In both scenarios it is important to consider what mix of growth and defensive assets is appropriate and going to produce the best outcome.

Get the latest news and insights from The Hopkins Group, as it happens.

Street Address

Postal Address

Contact Us

Office Hours