In Melbourne, 124 homes were scheduled for auction this week, down from 223 over the previous week and 545 this time last year.

With stage 4 restrictions in place until 14 September, open homes, private inspections and on-site auctions have ceased.

This has had a major impact on the number of auctions scheduled across Melbourne as the city continues to experience a decrease in sales throughout the lockdown period.

We expect this downward trend to continue for the next 3-4 weeks while buyers are limited to either making an offer sight unseen or via an online auction.

Interestingly the property withdrawal rate has been much lower relative to the previous lockdown period in April and early May this year.

The preliminary data collected indicates 31% of Melbourne auctions were withdrawn from the market this week, compared with a peak of 65% through the second week of April.

Of the 64 Melbourne auction results collected so far, 60.2% were successful, although this will be revised lower as the remaining auction results are collected.

Last week saw a final clearance rate of 60.8% recorded across the city, while this time last year, 69.3% of Melbourne auctions were successful.

Realestate.com.au reported that there were also 883 private sales in Melbourne this week, significantly fewer than the number sold last week (1,254) and the 1,262 properties sold by private treaty the week before.

What does the future hold?

It’s the silver lining to the COVID-19 recession for those fortunate enough to still have a job, who already own a home or are looking to purchase in the coming months.

Low interest rates are here to stay for the next 2-3 years based on reports from the RBA Governor Philip Lowe, leading economists and comments from Prime Minister Scott Morrison.

We also expect to see some great opportunities for investors and first home buyers ready to take advantage of prices either falling or remaining stagnant across the state.

Access to the new HomeBuilder grant is projected to stimulate the market with $25,000 available to anyone securing a house and land package or substantially renovating their existing home.

If you would like to confirm if you are eligible for any government grants please speak with a representative from The Hopkins Group.

Downward pressure on Melbourne rents

Asking rents in Melbourne have continued to soften, even though there’s been no further apparent increase in the vacancy rates this month.

Inner suburbs like Melbourne CBD, Southbank and Docklands have experienced some of the biggest falls in rent this quarter.

We think this is due to the increase in rental supply now owners are forced to search for tenants in the absence of overseas travellers.

Our property management team are stressing to clients the importance of caring for and maintaining your investment portfolio during this time as tenants won’t have to look far for a comfortable and affordable home.

The availability of online 3D tours is also proving to be a valuable asset for owners during these periods of isolation and social distancing.

Click this link to view a 3D property tour we recently shot for one of our clients in Ascot Vale.

This technology allows the user to view every corner of the property online from the comfort of their own home.

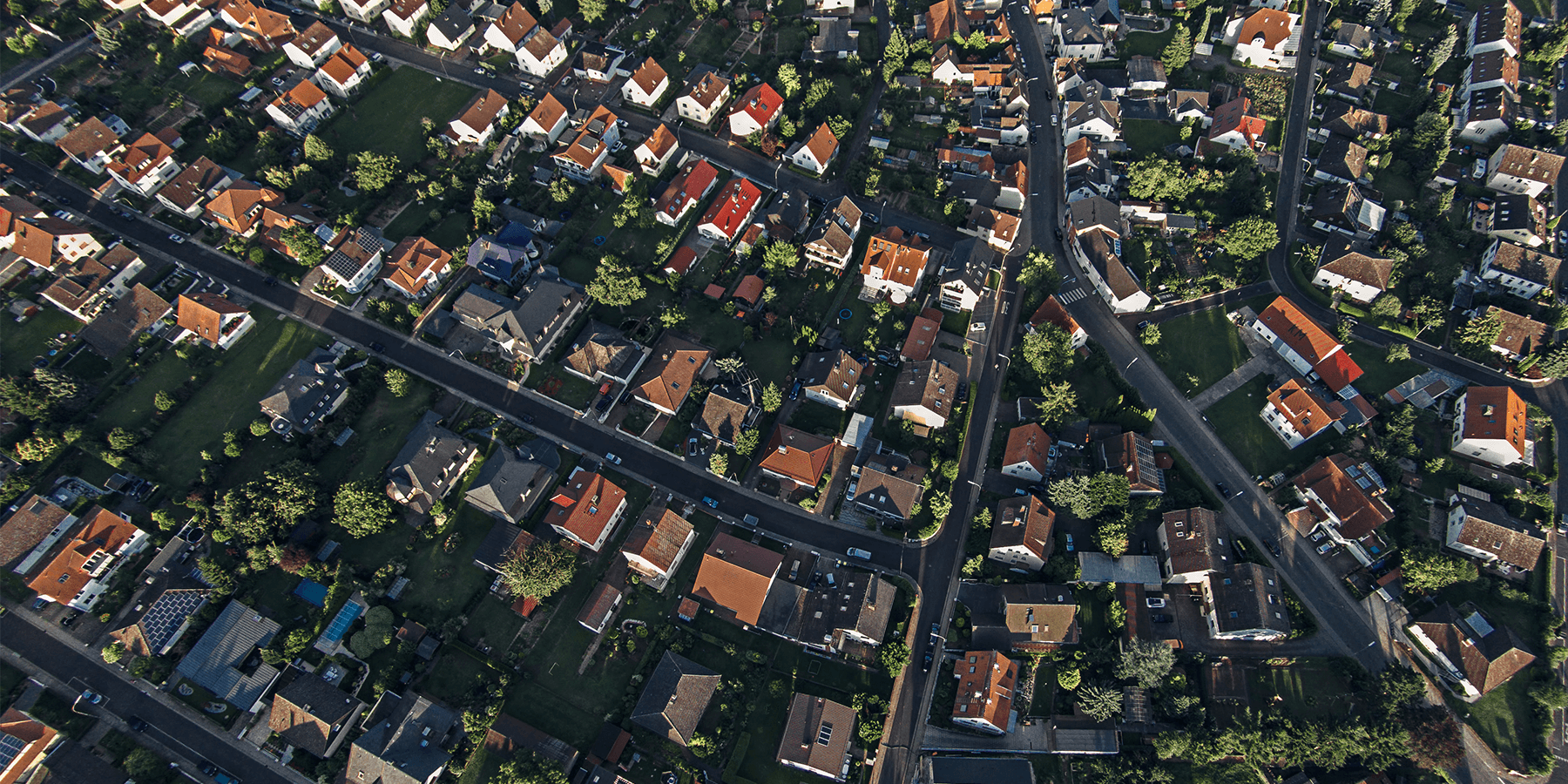

Why property investors shouldn’t be deterred from investing in Melbourne

Before coronavirus hit our markets, Melbourne property prices were surging with dwelling values up 12% on the previous year.

However, housing values in Melbourne moved through the fourth month of decline, racking up a cumulative 3.5% decline between the recent March peak and the end of July.

We believe this small and steady fall is no need for alarm as COVID-19 restrictions were almost certain to halt the markets progress.

The city’s housing market conditions have been weaker than Sydney and Brisbane, which we attribute to the states extended period in isolation.

Our lack of exposure to overseas migration and foreign students as a source of demand has also had a significant impact on recent figures.

Despite these weak conditions, buyer activity has improved over the past three months, after-sales fell by around 41% in April.

If Melbourne emerges from lockdown in 3-4 weeks’ time and cases continue to fall to similar levels in NSW, we expect a dramatic increase in activity and a similar resurgence to Sydney’s housing market.

Let’s talk property investment

So how is your property portfolio performing?

What are your short and long-term property investment goals?

Will your direction enable you to achieve the financial success and choices you’re looking for?

How are you assessing your investments’ performance?

The Hopkins Group property investment advisory team would love to help you answer these questions in an obligation free video meeting or phone call.

Melbourne’s population was forecast to increase by around 10% in the next 4 years and will remain one of the most liveable cities in the world when we get through to the other side of this pandemic.

If you’d like to talk about your circumstances and how we can help you discover sound investment properties across Melbourne please contact The Hopkins Group on 1300 726 082 or email info@thehopkinsgroup.com.au.