If you’re in a long-term relationship, chances are you’re probably not thinking about what happens when things go sour; but sadly, not all couples last forever.

When a married or de facto couple separates, often the first thought is to seek legal advice – which is always important – but what about financial advice?

There are often significant financial considerations both parties need to make, so seeking financial advice, including reviewing your financial position, revising your objectives and establishing a financial strategy are important for both your short and long-term future.

This article provides financial information to consider during a separation, including;

- Independent financial advice

- Identifying key financial positions across assets and liabilities, income and expenses

- Superannuation

- Rebuilding financial freedom, check your financial savings

- Insurance and risk mitigation

- Estate planning

1. Seek independent financial advice

It is unlikely to be appropriate for both parties to retain the same financial adviser.

Having separate advisers is generally preferable to maintain privacy and minimise conflict.

If both parties in the relationship have been using the same financial adviser historically, one member of the couple may need to seek an alternative financial adviser for their needs during the separation process.

Upon appointing independent financial advisers, the advantage to both parties is it forces both to become involved in their financial health and understanding.

Often in relationships, there is one member of the couple who has a greater understanding and interest in managing the finances. However, upon separation, both parties need to appreciate and understand their financial position and asset ownership structures.

2. Review financial positions across Assets, Liabilities, Income & Expenses

What is mine is yours and what is yours is mine. This is generally the preferred position for all parties when relationships are operating effectively.

However, in situations when a breakdown occurs how do we agree on what is mine and what is yours?

To separate this out, we need to take stock of your financial position as a couple and put together a combined list of:

- Assets (Home, savings, investments, etc);

- Income (Salary, rent, dividends, etc);

- Expenses (Food and groceries, bills, education, internet, etc); and

- Liabilities (Home loan, credit card, personal loan, car loan, etc).

This information is important for the lawyers when finalising the property settlement.

A financial adviser can assist you with ensuring the valuations are correct and support in understanding which assets may be suitable to retain in meeting your revised financial and lifestyle objectives.

Following the separation, it may be timely to conduct another review of your assets and underlying investment mix.

Your appetite for risk and investment timeframe may have changed considering your post separation position and adjustments may be required.

Professional advisers can guide, and support you in making informed decisions about your financial future.

3. Consider your super

Generally, couples in a relationship breakdown can extract information about their superannuation using information from their super fund or obtaining support from their financial adviser.

Extracting relevant content about your superannuation is important as it will be considered on how to separate assets, think in a situation where a prime bread winner in the family has been building up superannuation over many years whilst the other member of the family has been taking care of the household and care of young children and not working.

The latter person here may be in a position where they have no superannuation savings at all. On this basis it is possible part of the separation of assets agreement will include splitting a super payment.

Splitting super to a former spouse or partner does not mean it can be withdrawn and paid out as cash.

The super remains subject to preservation laws and the benefits split to the former spouse or partner cannot be accessed until that individual meets a condition of release (for example, permanent retirement after reaching preservation age of 56 or turning age 65).

Options for splitting super

A couple can make a superannuation agreement or obtain a court order to split a super payment or a super interest.

The superannuation agreement or court order must outline how the super is to be split.

Splitting a super payment to the former spouse or partner could be done by specifying a fixed dollar amount, a method for calculating an amount, or a percentage of a payment.

This is also another reason why it is critical for members in a relationship breakdown to seek their own financial adviser. Having the same adviser will impose many conflicts of interest and will not benefit either individual party.

A super split may be subject to tax implications as well as administrative fees for the transfer.

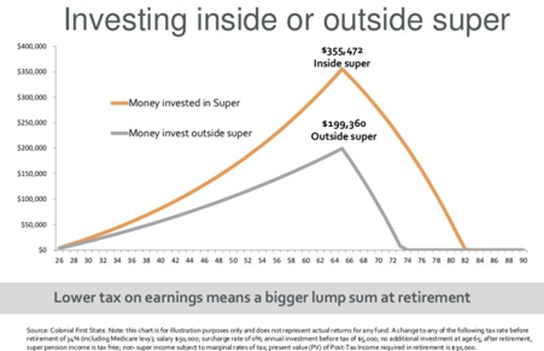

Upon finding relevant agreements upon splitting super, how do you invest these proceeds? This is a crucial question to answer – receiving financial advice to determine preferred asset allocation, your risk appetite and future investment goals is critical.

It is important that the client seek independent legal and financial advice before entering into any agreement to split super.

4. Meeting future income needs

When it comes to considering your income and expenses, you may encounter several obstacles that you may need to overcome as a result of your separation.

For example, if you and your former partner no longer live in the same household, it changes your expenditure patterns and obligations with the same level of resources which may now be constrained.

The same income from before the separation or divorce is now paying for two households and two sets of bills and expenses.

It is critical to know all your expenses and determine how these are going to be funded.

Thus, lifestyle or spending adjustments may be necessary.

There may be some tough decisions to make:

- If you have been a stay-at-home parent, you might have to re-enter the workforce; or

- One working part time may need to consider an increase in hours to provide additional cash-flow to meet future ongoing expenditure.

A financial adviser may be able to help you find a strategy to ensure your income needs are met in your post settlement financial position.

These may include:

- Budgeting and debt repayment strategies can be re-addressed, and priorities reassessed.

- A client over age 55 could consider commencing a Transition to Retirement (TTR) pension from their super if they need more income.

- Centrelink benefits can be explored. If there are dependent children involved, benefits such as Family Tax Benefits may be available. Older clients who are not working may consider eligibility for NewStart Allowance or Age Pension.

- When there are children involved, one member of a separated couple may need to pay the other Child Support. The level of child support depends on several factors, including the adjusted taxable income of each party, how much time the children spend with each parent, and the age and number of children. It can be dealt with in a BFA.

- Spousal maintenance may be payable and application for this can be made via the Family or Federal court. Under the Family Law Act 1975, a person has a responsibility to financially assist their former spouse or partner, if that person cannot meet their own reasonable expenses from their personal income or assets. This obligation can continue after separation and divorce and the level of support depends on what is agreed with the other party.

Rebuilding and checking your financial savings

Separation can have significant implications on a client’s cash-flow and financial position.

Initially, the client may need to defer their previous long-term savings objectives for more immediate short-term strategies which address their current situation.

However, it is important to also review the client’s longer-term financial goals and retirement plan.

Retirement timeframes, saving and super contribution strategies and retirement income objectives may need to be adjusted.

Seeking support via a financial adviser can assist the client in establishing and working towards these new goals.

5. Insurance and Risk Mitigation

Following separation, insurance needs are likely to change.

Your insurance needs analysis is likely to have changed due to the relationship breakdown, it is therefore critical to work with a financial adviser to determine what type of risk mitigation strategies are relevant going forward, these may include:

- Expunge current or future debt obligations;

- Ability to meet ongoing expenditure associated with school, education, rent, mortgage repayments; and

- The level of cover for insurance may need to be adjusted based on the revised assets, debts and incomes.

These situations are particularly amplified in a previously dual income family. In the event of not being able to work due to illness or accident, you will no longer be able to rely on your spouse or partner’s income, making Income Protection a more critical cover.

6. Review your estate plan

Separation alone will not cause a will to be invalid even if you have bequeathed all assets to your now former spouse or partner.

The effect of divorce on a will varies depending on the state you live in.

Therefore, separation should be a key trigger for you to review your estate plan to ensure that it continues to reflect your needs and intentions.

A will and power of attorney both need to be addressed, as well as non-estate assets such as superannuation, a family trust and any joint assets.

You may wish to update your affairs to remove their former spouse or partner as a life insurance and superannuation beneficiary, revoke any gifts to them in your will and appoint another person as attorney and/or executor of your estate.

A financial adviser can work with you to update your estate plan in conjunction with a lawyer or estate planning specialist.

Conclusion

Relationship breakdowns take a toll – both emotionally, but often mentally and financially. However, seeking appropriate advice can help you get back up on your feet.

Every situation is different, so it’s important to make informed decisions based on your own set of circumstances.